Make faster decisions and better predictions

A new way to track Smart Money moves

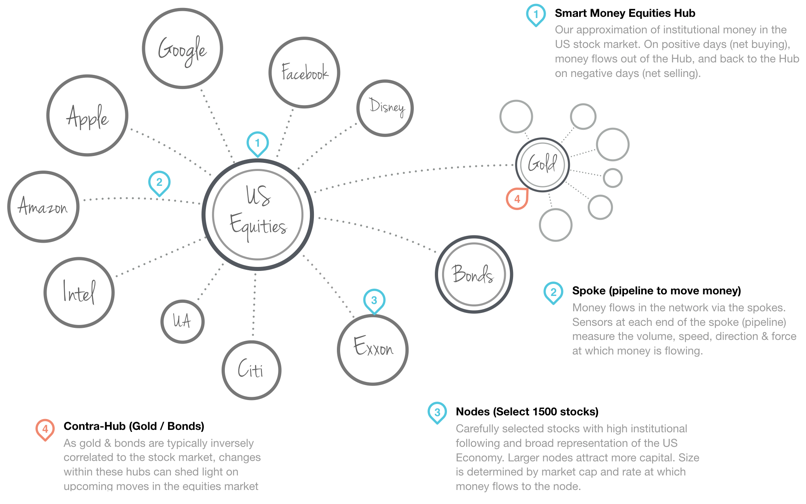

Institutional investors drive the stock market. We as investors, want to understand how large institutions are positioning themselves so we can make better profitable decisions. Gainsmaker uses machine learning to extract the collective intelligence of institutional investors and distills it into three simple indicators that forecast future market moves.

Existing methods to determine institutional sentiment – such as looking at block trades, SEC filings, or put-call ratios – have drawbacks, being either short term, myopic, lagging or possibly skewed by a few market participants.

Our approach overcomes many of these limitations and uncovers not only the confidence level of institutions and their current appetite for risk, but also what they are likely to do in the next 1-2 weeks!

I am a professional money manager who manages several million dollars of private and institutional clients. Gainsmaker is a GAME CHANGER, if you use it right! It gives me the confidence to stay in certain trades, knowing what the market sentiment is. That kind of information is priceless!!!

The intelligence behind our innovative approach

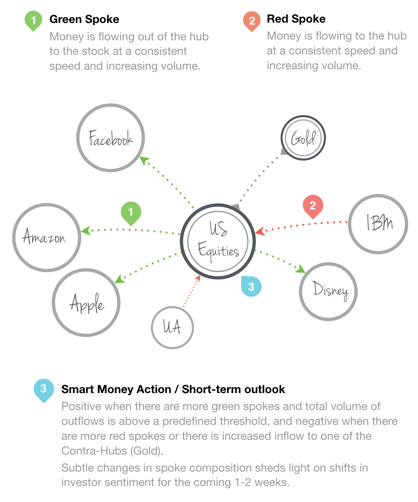

How we extract collective intent of Smart Money in the stock market.

As a portfolio manager, I can now focus on the fundamental analysis I do best because Gainsmaker provides me with the important tactical data that any investor should consider before trading a position. Its proprietary technique, I have found extremely helpful in framing investment decisions, especially around timing.

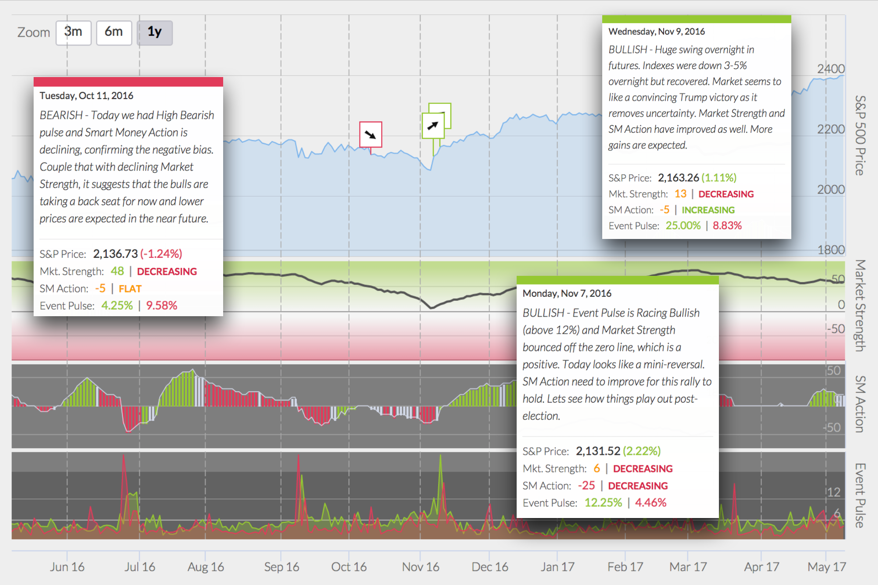

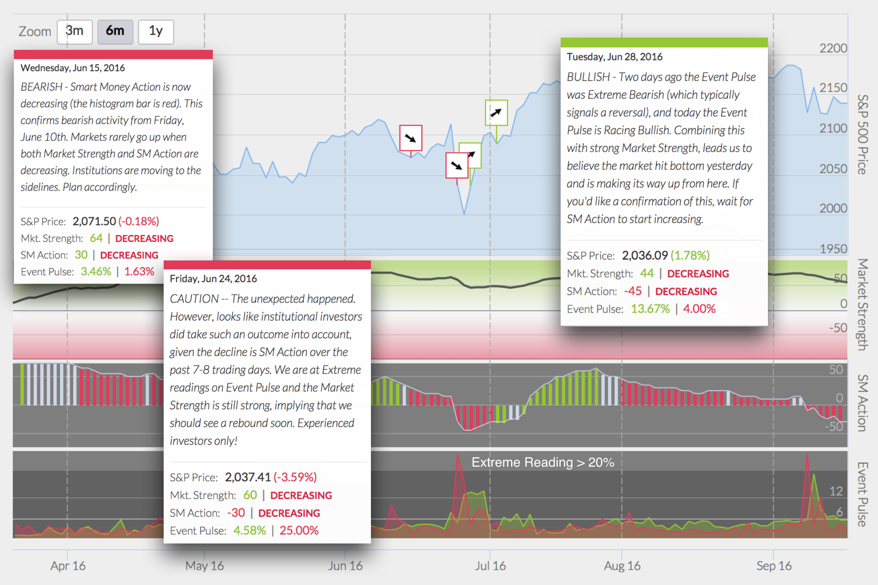

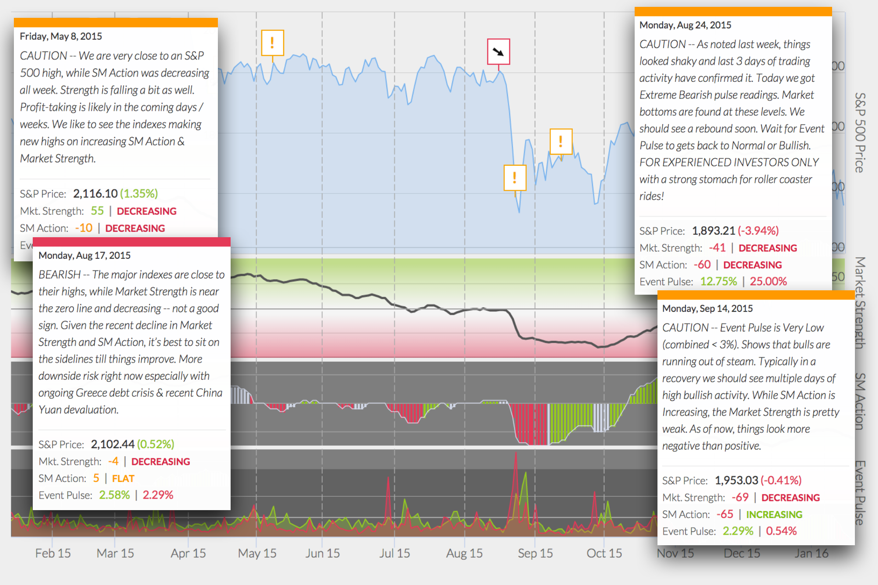

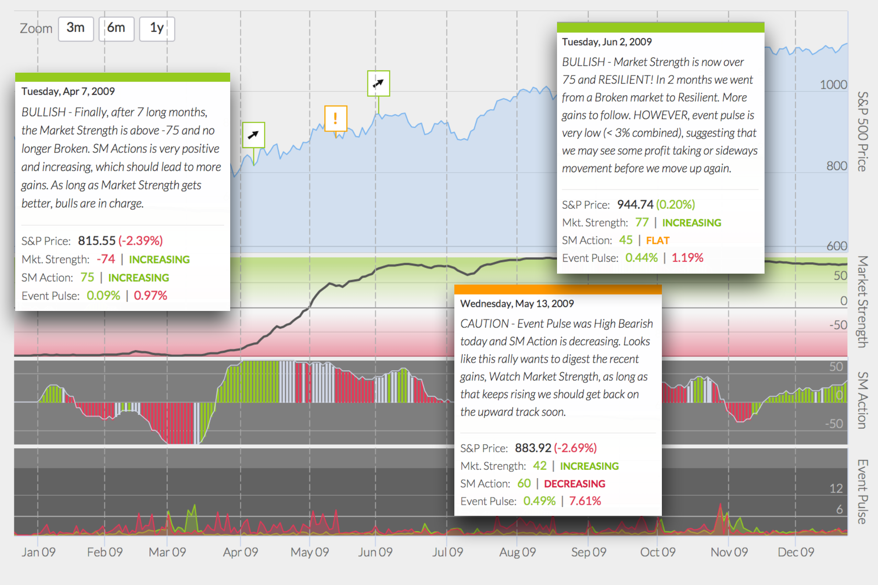

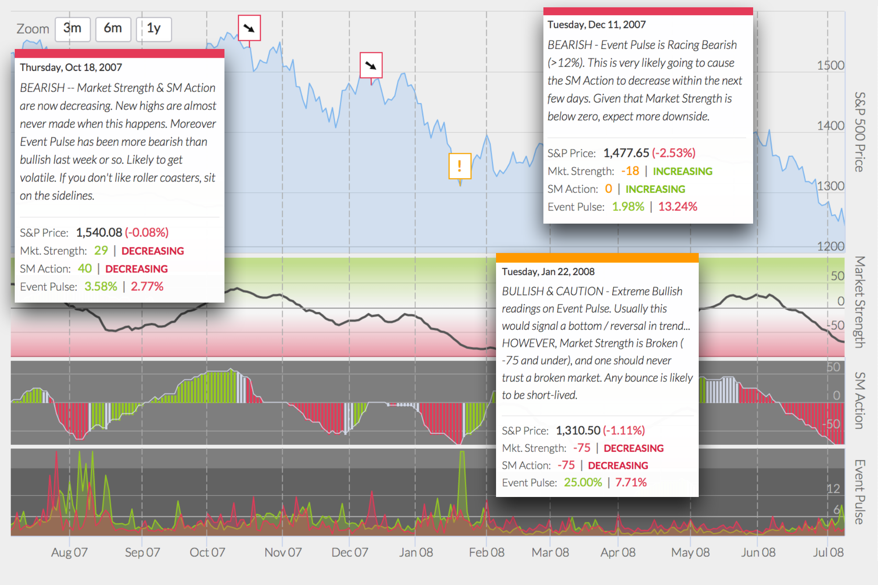

An early warning system for your portfolio

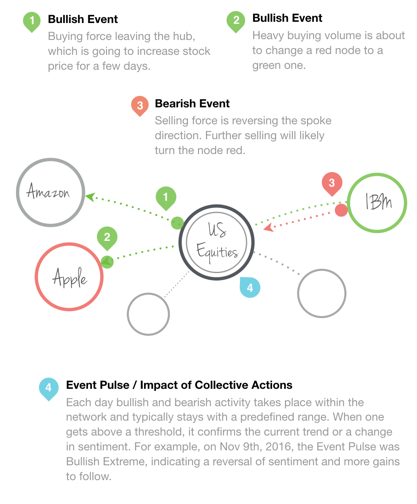

At the end of each trading day, Gainsmaker scans the institutional activity and events to identify inflection points or areas where stock prices are more likely to change or reverse. We generate alerts notifying you on price levels to watch or if the action is bullish or bearish.

Our predictive algorithms self-adjust to changing market conditions and capture both fundamental and technical influences on the market. Given that traders and institutions pay attention to technical levels, we pick up changes in money flow around those technical levels. Similarly, we detect changes in money flow when institutions are making value plays or investing in stocks on fundamental data.

Gainsmaker is like having a close friend who’s an analyst. Except this friend is always available, almost always right and you don’t feel bad bugging them! I’ve been using Gainsmaker for a few years and it has given me some fantastic opportunities and kept me from making mistakes!